Here’s what we know about the Affordable Care Act: 32 million Americans who would otherwise be uninsured will now have coverage. What you might not know is that Obamacare could also boost entrepreneurship by decoupling healthcare from employment. The pressure to be employed by a larger company is loosening as the Affordable Care Act makes it easier and less expensive to purchase individual coverage.

California Tax Change Will Hurt Entrepreneurs and Job Creation

The removal of a state tax incentive for investment in startups is likely to make capital scarcer for California companies most poised for high growth—harming job creation and an already vulnerable state economy in the process. The change breaks with current federal policy and puts California’s entrepreneurs at a relative disadvantage to those in other states. We estimate that investments in California’s startups will decline by a conservative 2 percent each year from the tax change—translating to a drop of at least $85-$127 million annually based on 2011 data.

In December, the California Franchise Tax Board (FTB) announced changes to capital gains tax exclusions on Qualified Small Business (QSB) stock holdings. The change stemmed from an appellate court ruling that found minimum in-state asset and employment requirements during the holding period of the QSB stock unlawful under the U.S. Commerce Clause. Rather than remove the in-state asset and employment threshold requirements, the FTB instead chose throw the baby out with the bathwater and eliminate the capital gains tax exclusions altogether—effectively increasing state taxes on investments held in QSBs from 4.65 percent (under a 50 percent exclusion) to 9.3 percent (under zero exclusion).

The real attention grabber has been the FTB’s choice to make the change retroactive to 2008—with penalties and interest—despite the fact that investors were following what was then current law. While investors are up in arms over this, entrepreneurs may actually have the most to lose moving forward.

Capital is the lifeblood of startups. This move by the FTB, which amounts to a tax hike for investors, will likely make capital scarcer for young businesses. Fewer startups means less job growth; for the last 30 years, young companies have provided all of the net new job creation in California and the United States as a whole.

Matching an existing framework with data on California, it’s possible to generate a conservative, back-of-the envelope, estimate of investment startups in the state might lose. This drop would likely have a negative impact on the California economy—not only have startups been the engine of new job creation in the state, but the QSB capital gains tax exclusions were targeted especially at businesses with the highest growth potential.

Estimating Investment Impact of Tax Change

A 2012 Kauffman Foundation report provides the framework for estimating the impact of tax changes on early-stage investments in startups. The report yields a conservative estimate of the additional investment in startups that would occur if 100 percent of the capital gains held at least five years were excludable from federal taxation, compared with an earlier exclusion of 50 percent. In other words, the report tells us how much investments of this nature might increase when taxes are reduced.

We employ that same framework here but move in the opposite direction, answering the question: how much would investments in startups decline from what amounts to a tax increase? Then we apply this estimate to data on investments in California startups.

Let’s unpack the potential investment response to the tax increase by using a hypothetical example. The Kauffman report states that a reasonable assumption for a real pre-tax return on privately held investments in startups in the current interest rate environment is 10 percent. At least one prominent angel investor group agrees, and so do we.

Under this assumption, an investment of $100 would be worth $161 after five years on a pre-tax basis. If the tax rate were 4.65 percent, as it was under the previous 50 percent exclusion in California, that same investment would be worth $158, for an average annual return of 9.6 percent. Under a 9.3 percent tax rate regime (zero exclusion), that same investment would be worth $155—returning 9.2 percent per year on average. Capital gains in QSBs are currently fully excludable from federal income taxes and were in 2011 as well—the base year used in our analysis.

A change in the effective tax from 4.65 to 9.3 percent results in a 4 percent drop in the average annual return on the investment (from 9.6 percent to 9.2 percent). Based on previous research on the topic, and conversations with experts in the field, the Kauffman report concluded that the responsiveness (the “elasticity”) of such a change in the rate of return on aggregate investments is a conservative 0.5—or half the change in return. In other words, the 4 percent decline in a typical return would result in a 2 percent drop in investment overall. Two percent may not seem like a big decrease, but when applied to a large base like in California, it can be.

To see how big of a dent 2 percent could make, the baseline estimate of equity invested in California startups is tabulated from three sources of “seed funding”:

Seed-Stage Investments in California Startups (2011)

| Source of funding | $ (in Billions) |

| Venture capital | $0.5 |

| Angel investors | $2.8-$4.4 |

| Entrepreneurs' equity | $0.8-$1.2 |

| Total | $4.1-$6.1 |

Sources: PricewaterhouseCoopers MoneyTree, Center for Venture Research, Silicon Valley Bank, Kauffman Foundation; Engine calculations

In total, an estimated $4.1-6.1 billion was invested in California seed-stage startups in 2011. It is reasonable to assume that essentially all of these seed funds were invested in traditional C corporations—the type of company that is most suitable for startups and is eligible for the QSB tax deduction. For scope, that amounts to between 32 and 47 percent of such investments in the entire United States.

With a baseline of $4.1-6.1 billion, and a 2 percent reduction in investments from the tax change, we’re left with a decline of $85-127 million in investment in startups each year in California. Now, $85-127 million per year may not sound like a whole lot of money relative to total investments in startups broadly, but over ten years it totals between $853 million and $1.27 billion. Moreover, whether we are talking about an annual or decade-long framework, considering that seed-stage companies may receive as little as $15,000 in funding (though a typical amount is in the hundreds of thousands), we’re talking about a lot of companies that may be adversely affected.

What’s more, this is almost certainly an underestimate of the value of investments in California startups and the effect the tax change would have. To begin, the Kauffman report reiterates that its framework is likely to yield conservative estimates. Most notably, it states that the elasticity estimate of 0.5 is likely conservative—meaning that for each 1 percent decline in a typical rate of return, overall investments would fall by more than 0.5 percent.

Secondly, since QSB status in California applies to companies with up to $50 million in assets, many businesses beyond the “seed/startup stage” would qualify. As a result, we are surely undercounting the pool of investment in the state that would be affected by the tax change.

Third, the 2011 statutory state tax rate applied here (9.3 percent) is lower than the marginal rate charged to those with incomes above $1M (10.3 percent), which would apply to a non-trivial number of investors in startups. These investors would be adversely affected even more than our rough estimates indicate.

Finally, the Kauffman framework was previously applied to federal tax—which would be applied uniformly across states. Holding federal tax rates and all other factors constant, other states would have an advantage against California. According to the Angel Capital Association, twenty states have tax incentives for angel investors and California isn’t one of them. For example, states like Wisconsin are actively partnering with investors to increase investments in startups.

In addition to all of this, Proposition 30, which was adopted by California voters in November, raises state income taxes to varying degrees on individuals who earn more than $250,000 per year. Though this is outside the scope of our analysis—both because the year studied pre-dates that particular tax hike and because arguing the merits of state tax policy broadly goes beyond what we’d like to accomplish here—it will further compound the issue, potentially leading to even more declines in investments in California startups.

Economic Impact

Though data are not readily available to directly tie investments in QSB-type businesses specifically to the economic impact in California, data from the Census Bureau can illustrate the important role that new businesses play in job creation in the state.

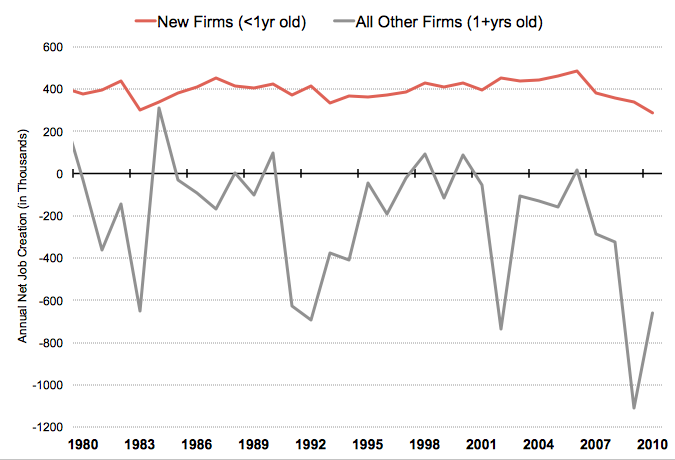

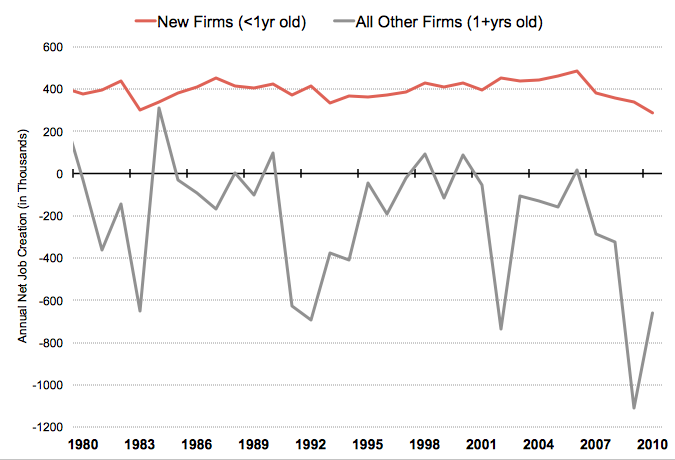

California Private-Sector Annual Net Job Creation by Firm Age (1980-2010)

Source: U.S. Census Bureau, Business Dynamics Statistics

Between 1980 and 2010, businesses in their first year added an average of 398,193 new jobs each year. Companies aged one year or more, as a group, subtracted an average of 192,501 each year during that same period. This occurred because the forces of job destruction (through business contractions and closures) were stronger than the forces of job creation (through firm births and expansions) for businesses older than a year old as a group. In other words, outside of startups, net job creation in California was negative during the past three decades.

In addition to the job creation dynamics of new firms, among existing businesses it is young firms (those less than five years old) that have the biggest effect on job creation. Taken together with the chart above, we can say that new and young firms are responsible for all net new job creation during the past few decades.

Conclusion

The FTB’s tax change is likely to reduce investments in California’s startups by a conservative 2 percent each year, translating to $85-$127 million fewer investments annually based on 2011 data. This can’t be a good thing for the economy or job creation in the state. At a time when the state unemployment rate hovers around 10 percent, California can hardly afford to place any of its companies at a competitive disadvantage—especially not those poised for high growth. On top of that, a recent survey of small businesses sponsored by the Kauffman Foundation found California to be among the least friendly for entrepreneurs.

Though it is understandable that state authorities are searching for ways to improve the fiscal situation of California, this isn’t a good way to go about it. The entire point of providing a tax incentive for these investments is to make them more attractive to investors, relative to others, precisely because seed-stage investments are very risky and because startups have important spillovers to the economy—namely that they fuel economic growth and job creation.

Moving forward, not only should state policymakers reinstate the QSB capital gains exclusion, they should extend it—making capital gains on these investments fully excludable. There is already precedent for this at the federal level too: in 2010 Congress temporarily made these investments fully excludable and recently extended this policy through 2013. If Washington can see the wisdom in doing this, why can’t Sacramento?

Ian Hathaway is the research director at Engine

CircleUp Cofounder Rory Eakin on JOBS Act

The passage of Jumpstart Our Business Startups Act in February was praised by entrepreneurs and investors as a long overdue update to the startup financial regulation landscape. The JOBS Act eases access to investors for startups raising capital by removing the ban on general solicitation and allowing equity crowdfunding. However rules need to be set by the Securities and Exchange Commission before these provisions can be taken advantage of by startups.

Rory Eakin, cofounder of CircleUp, a startup that connects startups and investors, testified at a Joint Session of the Committees on Oversight and Government Reform and Financial Services September 13 to urge government to rapidly implement provisions of the bill. He spoke to Engine about his experience as an entrepreneur engaging directly with policymakers about the issues that affect his startup. Eakin’s testimony served as a reminder of the spirit of the bill as well as a timely nudge to keep the implementation process in motion, and demonstrates the value of startups participating in the policy making process.

Engine: How was the experience of testifying?

Rory Eakin: It was tremendously exciting, and pretty encouraging to see the level of engagement and attendance from the two subcommittees and on both sides of the aisle. There was a lot of enthusiasm for the JOBS Act. Many people have different perspectives on the ways it should be implemented, but there’s a lot of unity on the overall mission to support startups and to help them grow.

E: In your testimony you talk a lot how JOBS Act might help to open the investor market up. How do you think this would help your business and other startups?

RE: One of the most important messages we were bringing to light at the hearing is how concentrated the early stage investment market is. When you look at the data, a lot of venture capital and angel investment is concentrated in technology startups and in specific geographies. The real benefit of the JOBS Act for CircleUp is being able to spread investment to broader geographic areas and to areas not historically associated with early stage investment. CircleUp connects high growth startups to networks of accredited investors -- the JOBS Act represents a great opportunity to lift some of the burdens associated with investment in companies or geographic areas not previously well served by investor networks.

E: The rules just came out for the changes to general solicitation last month -- what impact do you think this provision will have for startups?

RE: We haven’t seen a direct benefit yet because we’re still waiting for implementation. Title II (the change in general solicitation) to us is the most important part of the bill, because it will enable companies to reach out to their consumers, and others very familiar with the brand already, to inform them that the company is raising capital and there are opportunities to invest. It’s a way of making a more efficient marketplace where buyers and sellers can come together. We want there to be an ecosystem that attracts high quality companies and high quality investors. We’re also anxiously awaiting the rules for Title III, crowdfunding, which will be very important for a number of other startup companies in gaining access to investor capital which will allow their businesses to grow and thrive.

E: What advice would you have for other entrepreneurs about engaging with policy that directly affects their business?

RE: There’s a lot of receptivity in Washington for hearing the perspective of startups. We found our way to the panel through our own blog. It was a relatively smooth path from engaging with the issues through writing about the subject to then providing testimony. Legislators have so much on their plate -- the role of the startup in this situation is to make it accessible for them to understand how policy and legislation affects startups both negatively and positively. We take our knowledge on these issues for granted, but translating them for the legislator audience is key -- which is an important part of what you do at Engine. Implementation of JOBS Act is an ongoing issue, and we hope more folks pay attention to and recognize they can be influential in DC - I’d love to connect with anyone who is looking to do that through twitter @circleup.

UberX Threatened by DC Council Proposal

The Council of the District of Columbia is slated to vote tomorrow on a price-setting measure that, if passed, will block competition in the district’s transportation market. Uber, an Engine member and a startup that will be immediately affected by the proposal, is urging its users and concerned parties to call, email, and tweet to members of the council. For more information on how you can help, read Uber co-founder Travis Kalanick’s blog post. A petition has also been launched to oppose the measure.

The so-called Uber Amendment contains language that sets a minimum fare for sedan drivers offering transportation services. Startups like Uber, who offer a popular and efficient service, would not be permitted to charge less than five times the fare of a taxicab. Sedan prices would be set by law higher than those of competitors. Under the proposal, UberX, a lower-cost car service the company unveiled July 4, would not be able to operate in the Washington DC market.

Not only does the proposed amendment stifle competition, it poses a danger to a healthy and vibrant economy by preventing the growth of startups and the jobs they provide in the DC market. Engine urges its members to support healthy competition and disruptive startups like Uber by voicing your concerns with council members.

Update 7/10/2012: After receiving thousands of notes from Uber customers, the DC Council has dropped its plans to add the minimum fare amendment. Report in full at the DCist.

DC City Council Set to Vote Against Lower-Cost Transportation

The City Council in Washington DC is set to vote tomorrow on a measure that would stifle progress in the transportation industry -- specifically it would prohibit startup company Uber from offering a competitive service in the sector. Join us in calling members of the Council to ask them to protect innovation by voting against this proposal.

With a long, blighted history of corruption and malfeasance in the taxi industry, the city of Washington has long stood against progress in a vital area of transportation for the Nation's Capital. Earlier this year, Uber, who we're proud to say joined us last month for our Startup Day on the Hill event, launched their innovative, disruptive service in Washington alongside many other cities throughout the U.S. and around the world. Almost immediately, this move was met with resistance from the Taxi Commission, Mayor Vincent Gray and the City Council in an attempt to protect an existing taxi industry which has been fighting modernization for some time.

Tomorrow, the Council is looking to take another step backward against modernization of transportation in the District with the impending passage of a so-called "fare floor" for Uber riders. The proposal, according to an email sent earlier this afternoon by Uber CEO Travis Kalanick to the product's users, would set rates no less than five times higher than a minimum taxi rate. Instead of investing in a modern taxi fleet, or welcoming innovation in transportation in DC, Mayor Gray and the Council will instead seek to make an alarming move against innovation and a popular small business in DC by forcing rights sky high and making programs like the recently-announced UberX -- a lower-cost alternative to Uber's popular black car services that uses hybrid cabs -- impossible in the Nation's Capital.

Amidst the furor surrounding the impending votes, there is still an opportunity to change hearts and minds and keep transportation in Washington free for innovation and modernization. If you live in the District, or use Uber to get around DC, we are encouraging you to call members of the DC Council and register your displeasure with the proposed regulations. Here are their numbers, we hope you'll make the call.

Phil Mendelson (Chairman), (202) 724-8064, pmendelson@dccouncil.us

Mary Cheh, Ward 3, (Chairperson of Committee on the Environment, Public Works and Transportation), (202) 724-8062, mcheh@dccouncil.us, @marycheh

Michael Brown, at-large, (202) 724-8105, mbrown@dccouncil.us,

@cmmichaelabrown

Jim Graham, Ward 1, (202) 724-8181, jgraham@dccouncil.us, @jimgrahamward1

Jack Evans, Ward 2, (202) 724-8058, jevans@dccouncil.us, @jackevansward2

Muriel Bowser, Ward 4, (202) 724-8052, mbowser@dccouncil.us, @murielbowser

Kenyan McDuffie, Ward 5, (202) 724-8028, kmcduffie@dccouncil.us, @kenyanmcduffie

Tommy Wells, Ward 6, (202) 724-8072, twells@dccouncil.us, @tommywells

Yvette Alexander, Ward 7, (202) 724-8068, yalexander@dccouncil.us, @cmyma

Marion Barry, Ward 8, (202) 724-8045, mbarry@dccouncil.us, @marionbarryjr

David Catania, at-large, (202) 724-7772, dcatania@dccouncil.us, @cataniapress

Vincent Orange, at-large, (202) 724-8174, vorange@dccouncil.us, @vincentorangedc

Federal Trade Commission Review of Facebook-Instagram Gives Pause

The Federal Trade Commission is probing Facebook’s $1 billion purchase of Instagram, according to a May 10 Financial Times report. That the government is looking into the deal is no surprise -- the Hart-Scott-Rodino Act compels companies striking large deals to notify the FTC and Justice Department. While this first look is procedural, a deeper review may signal regulatory concerns about the deal.

Facebook’s purchase dwarfs the threshold for a “large” transaction under antitrust law, which uses an inflation-adjusted figure that was set at $68.2 million for 2012. So the Instagram purchase is literally a “big deal” to regulators, which means there is a 30-day waiting period before the deal can be consummated, or potentially much longer if the FTC decides to apply further scrutiny.

The two regulatory authorities -- the FTC and DOJ -- review transactions to ensure that companies do not possess “market power” that would harm competition. What does this mean? A post-merger company isn’t permitted to raise prices, reduce innovation or output, or otherwise harm consumers. It is important to note that it is harm to consumers, not competitors, that regulators primarily monitor. A transaction’s impact on competitors raises regulatory concern where it hits consumers, such as when a company controls supply of a good, which opens up the opportunity to unilaterally raise its price. An unnamed source suggested to the New York Times Bits Blog that the deal presents a threat to mobile advertising competition, potentially affecting prices.

A May 15 Securities and Exchange Commission filing by Facebook has ignited some speculation that the federal government is initiating a further review of the purchase. Facebook amended its S-1 ahead of the company’s initial public offering to extend the estimated closure of the deal. The filing originally anticipated the deal would close by the end of the second quarter, but the amended filing states that the deal is “expected to close in 2012.” (see page 66) Facebook also agreed to pay a $200 million termination fee to Instagram if the deal falls through.

In-depth antitrust review would likely play out over several months. Reuters reported May 10 that the FTC made inquiries to Google and Twitter about the transaction. Twitter also was rumored to have considered purchasing developer Tap Tap Tap’s Camera+ app after Facebook struck the Instagram deal. Neither the companies nor the agency are commenting on the process, so it is impossible to tell whether moves by other companies may have influenced the agency’s questions.

While a lot of noise has been generated about the regulatory probe, is it really likely that the government will pursue an antitrust injury created by the purchase of Instagram? The Obama administration has increased antitrust enforcement, particularly on horizontal mergers -- deals where companies acquire their direct competitors (think AT&T buying T-Mobile). Vertical mergers -- where one company purchases another in a different line of business -- have tended to see less competitive scrutiny (think Ticketmaster merging with Live Nation).

Moving to block the purchase of Instagram may pose a variety of new questions to antitrust experts, but should startups be concerned about the reports of an FTC probe? At this point, the likely answer is no. Most purchases won’t face the regulatory scrutiny that a buyer like Facebook generates. Between the company’s multi-billion dollar IPO, privacy investigation by the FTC, and acquisition activity, Facebook has repeatedly drawn attention from the government in 2012.

Government scrutiny of large companies’ acquisitions may be of growing importance to startups going forward, especially where industry-leading firms such as AT&T and Verizon aim to make acquisitions and face FTC or Justice Department review. Delaying the close of a deal can impede the development of small businesses and harm startups making the next step in the evolution of their businesses. Engine will update as the review progresses.

Midweek Policy Highlights

This week in Washington: the FTC goes deeper on privacy, Facebook amends its SEC filing to account for potential regulatory review, and immigration and spectrum remain hot topics.

Finance

Facebook amended its S-1 filing with the Securities and Exchange Commission ahead of its initial public offering May 15. The filing extended the expected closure date of the $1 billion Instragram purchase from the second quarter of 2012 to 2012 generally. The move could signal deeper scrutiny by regulators on the competitive impact of the deal. Currently, the transaction is in a procedural 30-day review under the Hart-Scott-Rodino Act premerger notification program. Engine will continue to monitor the review and its potential impact on future startup acquisitions.

Privacy

Associate director of the Federal Trade Commission’s division of privacy and identity protection Maneesha Mithal spoke at a Congressional Internet Caucus event on Monday about the agency’s recent report on privacy. She highlighted recent settlements with social networks including MySpace that involved companies’ adherence to their privacy policies.

Edward Felton, the agency’s chief technologist on leave from Princeton University’s Center for Information and Technology Policy, also blogged this week on the technical details of recent moves by the government to address privacy on social media platforms.

Immigration

Engine blogged earlier this week on moves by the Department of Homeland Security and Congress that may help startups gain access to more highly-skilled immigrant workers. Senator John Cornyn is said to be introducing a bill that would boost the number of visas available to immigrants with graduate degrees in science, technology, engineering, and mathematics fields.

Spectrum

Federal Communications Commission chairman Julius Genachowski is slated to give a speech May 17 at 10:30 EST on spectrum reallocated to support “medical body area networks” (MBAN). GE Healthcare and Philips Healthcare are scheduled to demo MBAN devices. Repurposing spectrum for new technologies is a major priority to open innovation across industries and MBAN is a major development in the healthcare field. A live stream can be viewed here.

JOBS Act Becomes Law

I was honored to represent the startup community across America this afternoon as a guest of President Obama in the White House Rose Garden as he signed JOBS Act into law. This bi-partisan bill will do great things for our community; through increased ability for companies to go public, raise money through crowdfunding or scale their products and businesses into the marketplace with greater ease.

The President, along with House Republican Leader Eric Cantor who introduced the bill in February, Sens. Jeff Merkley and Scott Brown who worked tirelessly on the crowdfunding issues, and many others in both parties and both Houses of Congress are to be thanked for making sure this legislation passed with the support and speed that it did. With Engine, I look forward to helping many new startups benefit from this law, and continuing to work with the Congress and the President to pass further legislation aimed at helping startups continue to drive the Engine of the American economy.

JOBS Act Passed, With Additional Investor Protections

Minutes ago, startup financing bill JOBS Act passed the Senate 73-26, with an amendment to further protect investors.

The bill, which we discussed here, seeks to ease the way for startups to access investment capital through provisions that address the transition between being a privately held company and a publicly traded one — eliminating the 500 shareholder cap, allowing general solicitation and crowdfunding, creating an IPO onramp — and provides startups with more financial pathways to success.

Concerns that greater access to investments — especially through the crowdfunding provision in the bill — prompted fears from many quarters that investors would be opened up to fraud, or worse, that a “free-for-all” environment for investing in startups would create a reiteration of the dot-com bubble burst. An amendment offered by Sens. Merkley (D-OR) and Brown (R-MA) passed along with the bill which addresses these concerns.

The amendment requires companies raising up to $1 million to be transparent with potential investors about certain financial information, and prevents investors with an income lower than $100,000 from investing more than 5% of their annual income.

JOBS Act always called for “reasonable protection” of investors against fraud, and now the Merkley/Brown amendment further distinguishes what safeguards will be extended on behalf of investors. Another amendment offered by Sen. Reed (D-RI) that changed the definition of the “emerging growth companies” that JOBS affects was rejected.

The Merkley/Brown amendment means the bill will go back to the House before being signed into law by the President. We’ll be tracking.

Policy Update: JOBS & Startup

Last night, we sent out the following email to our friends and members to inform them of current legislation aimed at easing the way for startups. We want to share the update with you now, as a resource for understanding key provisions of JOBS Act and Startup Act, and to hear your thoughts on these bills. If you want to sign up for email updates like this in the future, subscribe to our mailing list here.

Dear Friend,

Engine has been tracking recent legislative efforts to foster entrepreneurship and small business. Today, the Senate begins debate on the JOBS Act, which passed the House last week. Startup Act is next on the legislative agenda and responds to a number of key startup needs.

JOBS Act

The JOBS Act is a legislative package designed to lower barriers to entry for entrepreneurs by reducing limitations on fundraising and decreasing crippling bureaucratic overhead currently required by existing regulatory legislation. While there’s good and bad contained within it, it is heartening to see Congress prioritizing legislative issues that affect startups. You can read about the provisions we like in the JOBS Act.

- Ease of raising capital through crowdfunding and ease SEC regulations on offerings from $5 million to $50 million, making it easier for startups to raise capital.

- Create IPO onramp for class of emerging growth companies with annual revenue of less than $1 Billion.

- Emerging growth companies are subject to fewer SEC regulations when filing for IPO

But JOBS is just the beginning.

Startup Act

It’s time to move forward on Startup Act. We have only a few weeks left to effect change in Congress this session, and Startup Act represents another clear step toward passing legislation that benefits entrepreneurs and creates jobs -- this year. We also took a look at some of the key provisions in Startup, here’s a quick summary, with more detail available on our blog.

- Promote job growth by making the capital gains tax exemption for startups permanent.

- Reform the process by which qualified STEM graduates and foreign born entrepreneurs are able to stay and start businesses in the United States

- Spur innovation by providing incentives for universities to turn federally funded research into tangible jobs and businesses.

To take action on JOBS Act, sign the petition at AngelList here. And stay tuned, in the coming weeks we’ll ask you to take further action in support of Startup Act.

-The Engine Team

IPO On-Ramp For Emerging Growth Companies

Bill of the week: S.1933, or the Reopening American Capital Markets to Emerging Growth Companies Act of 2011. You might also know it as the Sub $1 billion Revenues IPO Act -- a shortened working title conferred by Fred Wilson at A VC, who championed the bill last Friday.

The bill amends the Securities Act of 1933 and Sarbanes Oxley to ease the time and financial burden of regulatory compliance for small companies going public. Specifically, the legislation would give “emerging growth companies” -- companies with revenues of less than $1 billion -- five years to comply with SEC regulations for an IPO. The temporary exemptions would allow smaller companies an eased path to IPO, while maintaining compliance obligations that protect investors. Eased regulations for IPO would give smaller companies greater access to markets and capital at a critical stage in their growth.

This bill corresponds to part of the Obama Administration’s Startup America Legislative Agenda, a detailed list of priorities released a month ago to spur job creation by addressing the needs of start-ups. We wrote about the agenda in detail here.

You probably already know how vital start-ups are to job growth -- Kauffman research shows that start-ups are responsible for nearly all net new job growth in the country since 1977. But in case you need a refresher, this video is short, sweet, and explains the issues well. Bottom line? Election year or no, stimulating job growth and the economy is a non-partisan issue.This is an important bill, and one that we want to see passed sooner rather than later.